Lower friction authentication for online payments

● Improve checkout conversion over standard 3D-Secure

● Merchant UX for strong customer authentication

● PSD2-compliant with support from leading issuing banks

SYGN X

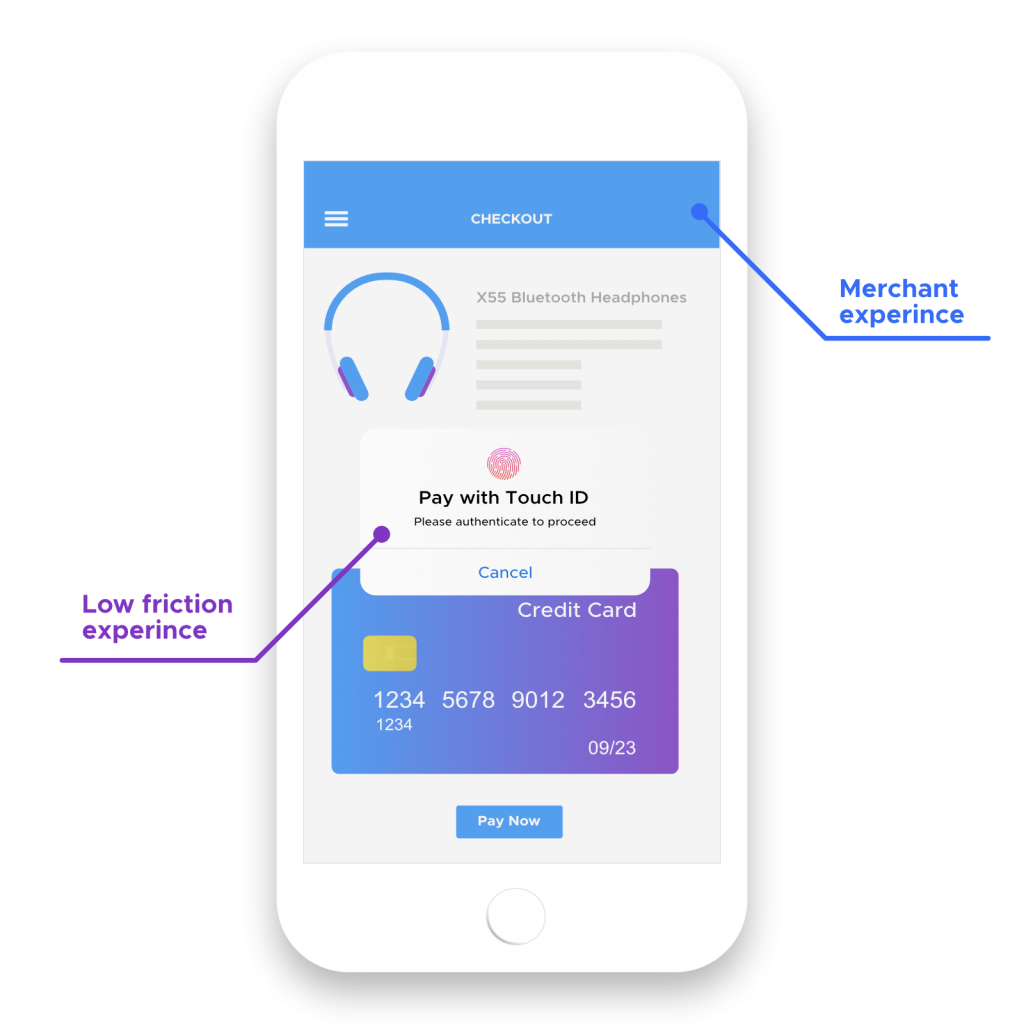

SDKs for Android and iOS for an improved authentication experience over standard 3D-Secure

Improve conversion over standard 3DS with low friction authenticators in the merchant’s experience.

PSD2 compliant with the support of leading European issuing banks.

Flexible integration options that work with the SYGN 3DS API or your existing 3DS provider.

SYGN 3DS

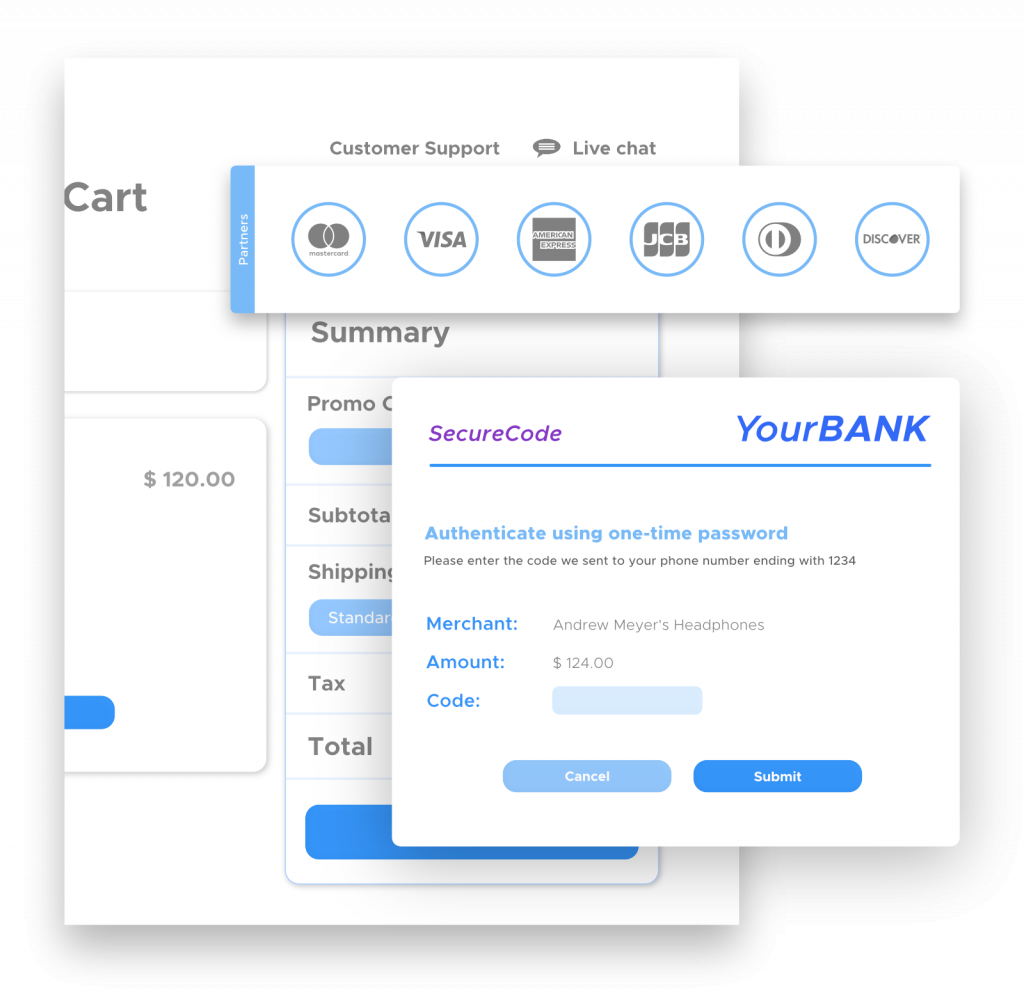

A simple API for strong customer authentication of credit and debit cards using 3D-Secure.

Global 3DS solution with automatic versioning between 3DS 2 and 3DS 1.

PSD2-optimized API to leverage regulatory exemptions to reduce friction.

Frictionless authentication in supported regions to mitigate fraud and improve authorization rates.

USE CASES

PSD2 COMPLIANCE

Problem: Starting in September 2019, issuing banks across Europe will require strong customer authentication (SCA) on digital payments in order to comply with Payment Services Directive 2 (PSD2). Merchants operating in Europe must adopt a 3D-Secure solution for card payments and add an authentication step to their checkout experience. Many merchants expect 3D-Secure to lead to a 10-20% decrease in checkout conversion as a result of the added friction during checkout.

SYGN Solution: Sygn provides merchants with a 3DS solution (Sygn 3DS) that is optimized for PSD2 to reduce friction. Sygn automatically identifies transactions that are eligible for regulatory exemptions and provides support for both 3DS 2 and 3DS 1 with a single integration. For mobile apps, the Sygn X experience replaces the standard 3DS challenge with a merchant owned experience for higher checkout conversion rates.

FRAUD MITIGATION

Problem: In many regions, merchants struggle with online fraud but have avoided implementing 3DS 1 due to poor conversion rates. Until recently, merchants needed to make a choice between more fraud or more friction.

SYGN Solution: Sygn 3DS supports the newest version of 3DS 2 to facilitate frictionless risk based authentication helping merchants mitigate fraud, shift fraud liability to issuing banks, and improve payment authorization rates.

INTERNATIONAL ACCEPTANCE

Problem: In many regions, strong customer authentication is required by issuing banks to accept certain credit and debit cards. Issuers in Brazil and Turkey, for example, require strong customer authentication on debit cards for online payments. Merchants that do not enable 3DS are unable to accept cards held by millions of potential customers around the world.

SYGN Solution: Sygn 3DS facilitates the necessary authentication experience to accept credit and debit cards that require 3DS for online transactions, helping merchants expand access to shop on their platforms to millions of new potential customers.

PARTNER WITH US

MERCHANTS

Implement a better 3DS solution that optimizes to reduce friction and enables the differentiated Sygn X experience for mobile apps.

PAYMENT SERVICE PROVIDERS

Resell Sygn products to your merchant base with our off the shelf products or embed Sygn technology into your products and services.

ISSUERS

© Sygn Financial Technologies, Inc. 2020

Seattle WA | Vancouver BC